The reason that the market has been doing well until now is the combination of low inflation and high profits; that explains why valuations are so high. US profits may have retreated from their peak (as a percentage of GDP) but will probably regain those highs by the end of the year. The puzzle is why profits have been high, and this may well be down to growing monopoly power in the corporate sector. So what will cause the market to retreat? It will be a variety of factors; rising inflation leading to higher nominal (and real) interest rates, plus wage pressures as demographic factors mean that the developed world starts to run short of labour. Returns from developed world equities, and from government bonds, will be low: too low for US pension funds to achieve anything like their 7-8% targeted returns. The best hope for investors lies in emerging markets which are cheap, relative to US equities, but not as cheap as they were. Indeed, a wide range of asset classes have been driven higher in recent years; a rule of thumb is that yields on farmland, timber of commercial property and around two percentage points lower than they used to be. In short, the melt-up could still happen (he thinks the odds are around 40%) but enjoy it while it lasts. The longer-term outlook is desperately unexciting. ~ Jeremy Grantham

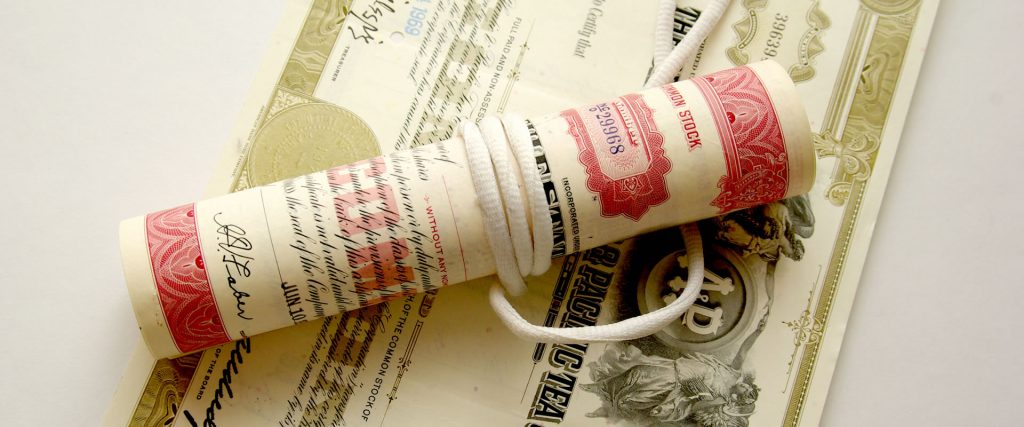

S&P Large Caps (SPX), Buybacks (PKW)

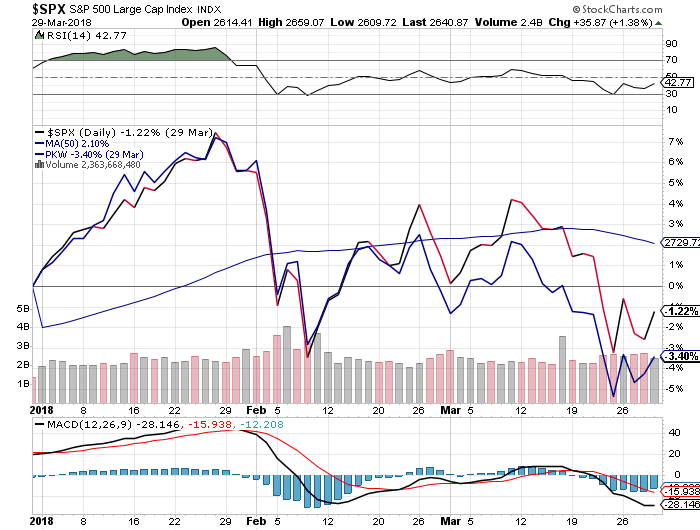

U.S. Small Caps (SCHA), U.S. Mid Caps (SCHM), U.S. Large Caps (SCHX)

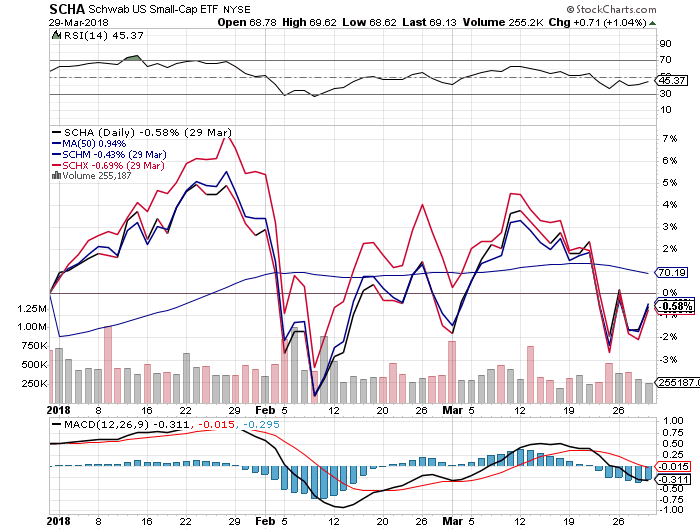

U.S. Aerospace & Defense (ITA)

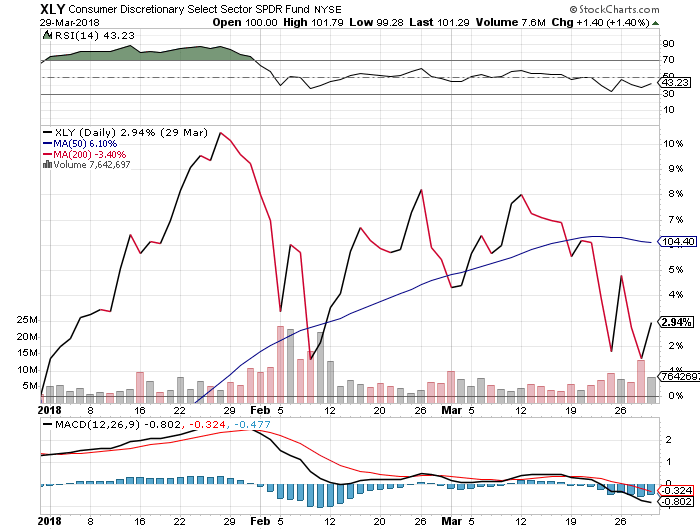

Consumer Discretionary (XLY)

Consumer Staples (XLP)

Industrial Select (XLI)

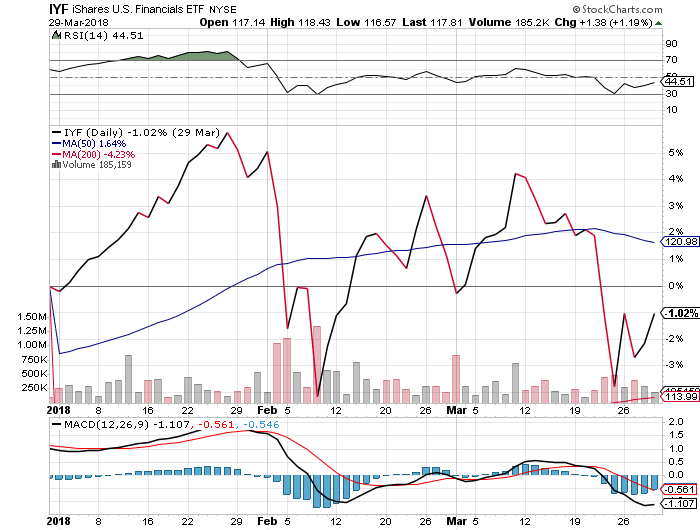

U.S. Financials ETF (IYF)

S&P Regional Banking (KRE)

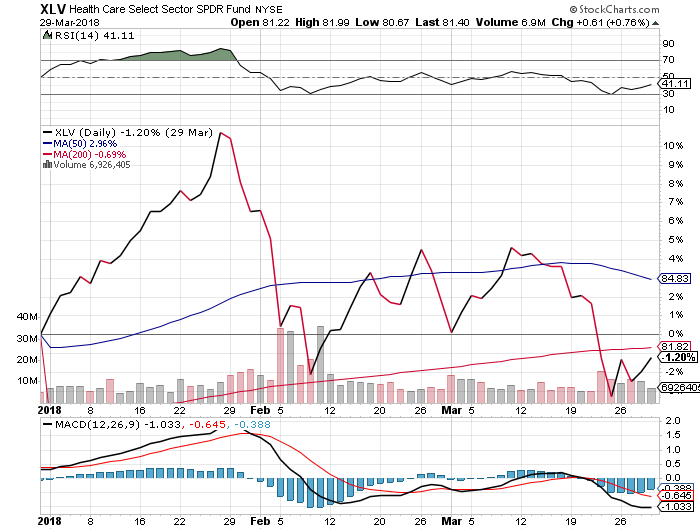

Health Care (XLV)

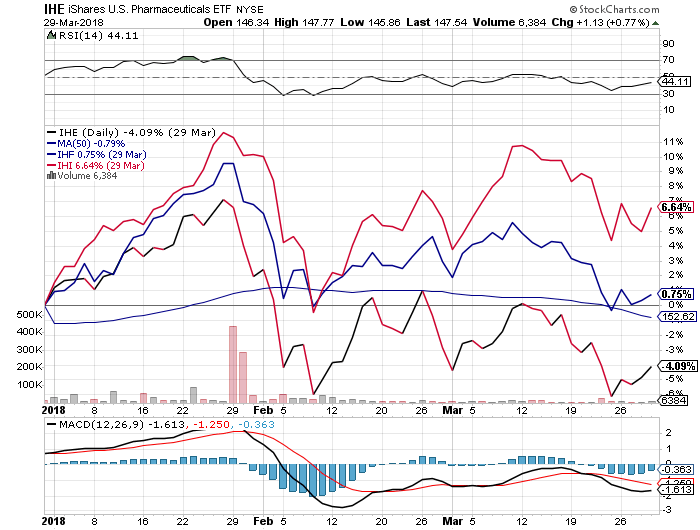

U.S. Pharmaceuticals

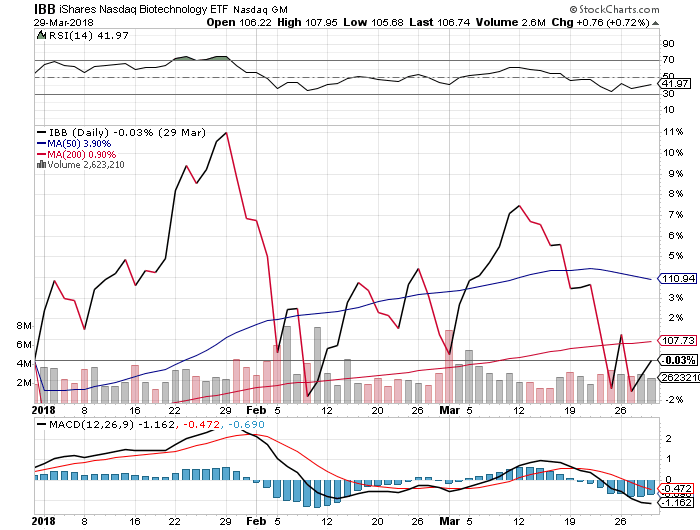

Biotech (IBB)

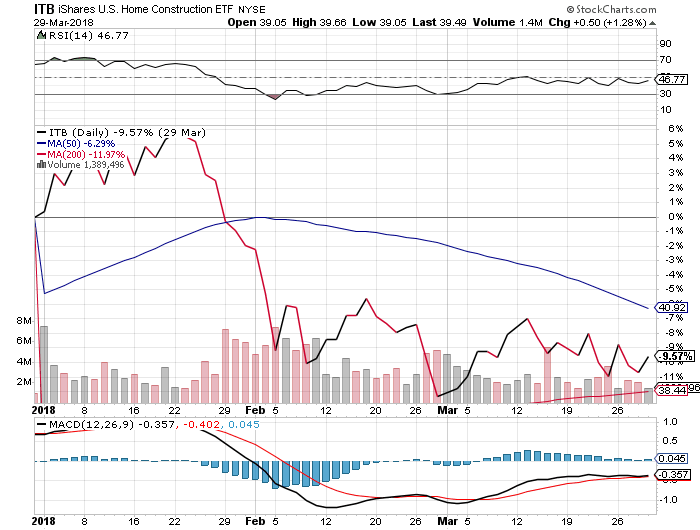

U.S. Home Construction (ITB)

U.S. Real Estate (IYR)

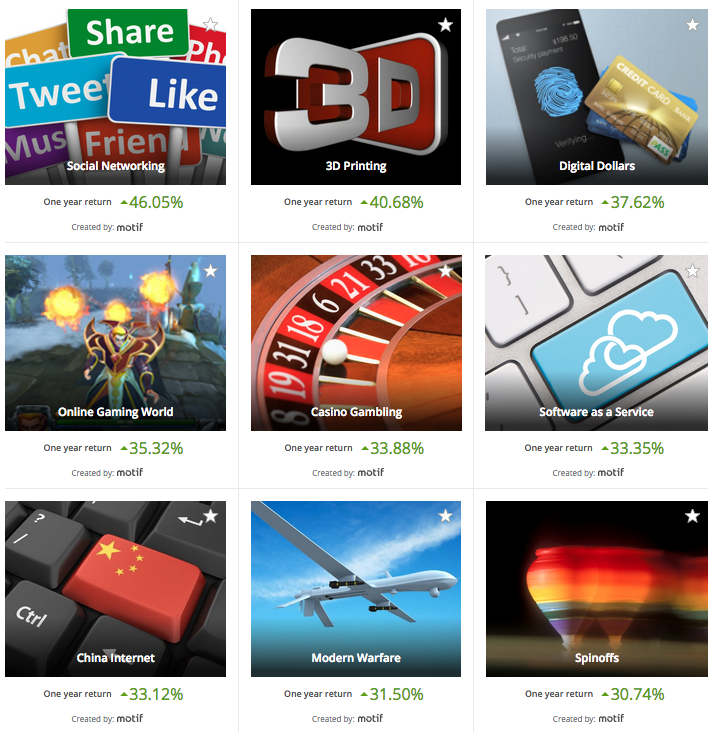

Motif Investing: Highest Earners (1-Year Returns)

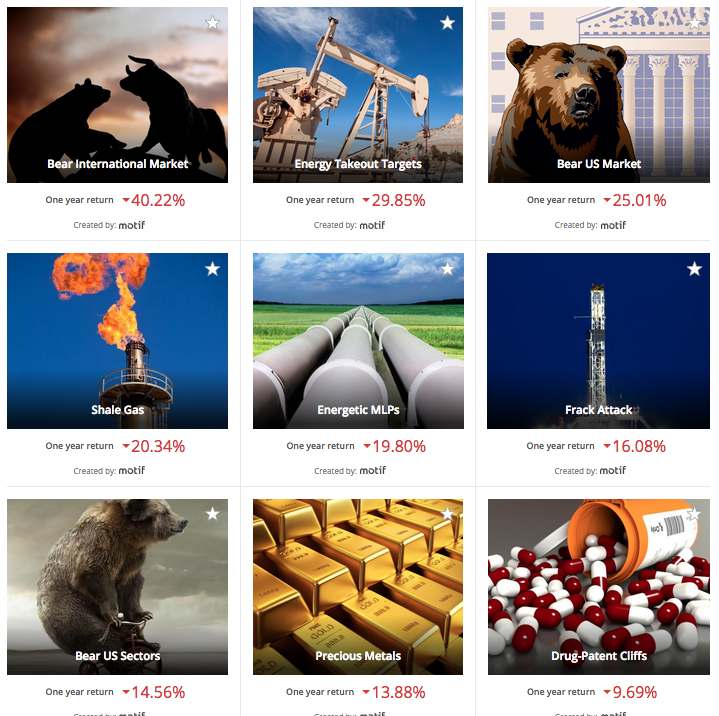

Motif Investing: Lowest Earners (1-Year Returns)

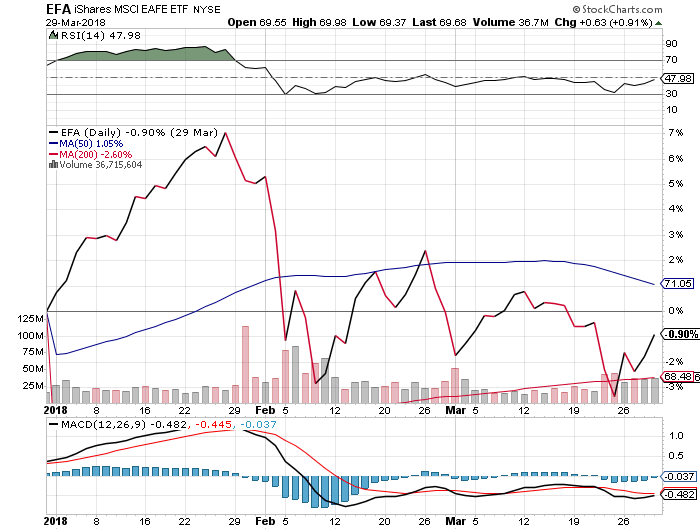

International Developed (EFA)

Europe

Germany (DAX)

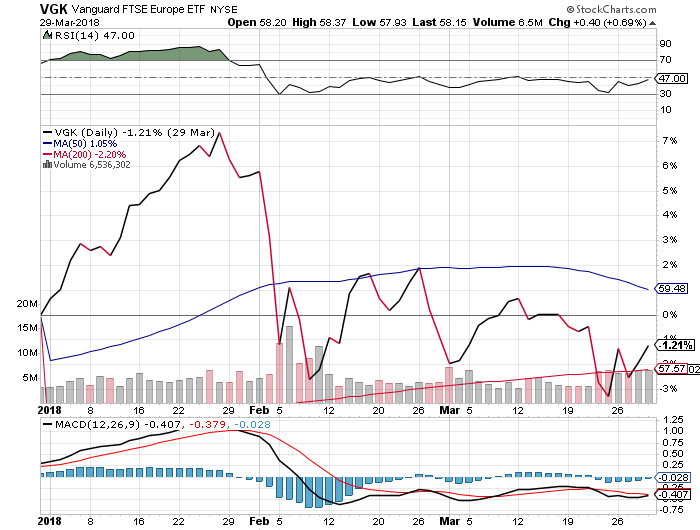

FTSE (VGK)

VGK (FTSE), EWU (UK), SPY (S&P)

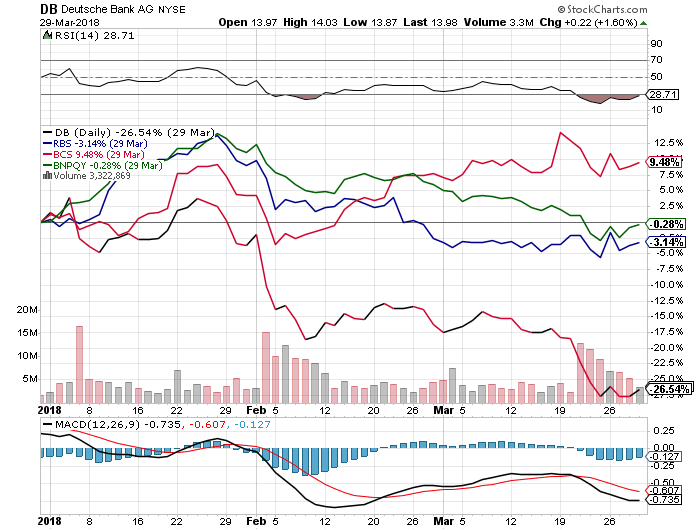

European Financials (EUFN), U.S. Financials (KBE)

European Financials: Deutsche Bank (DB), Royal Bank of Scotland (RBS), Barclays (BCS), Paribas (BNPQY)

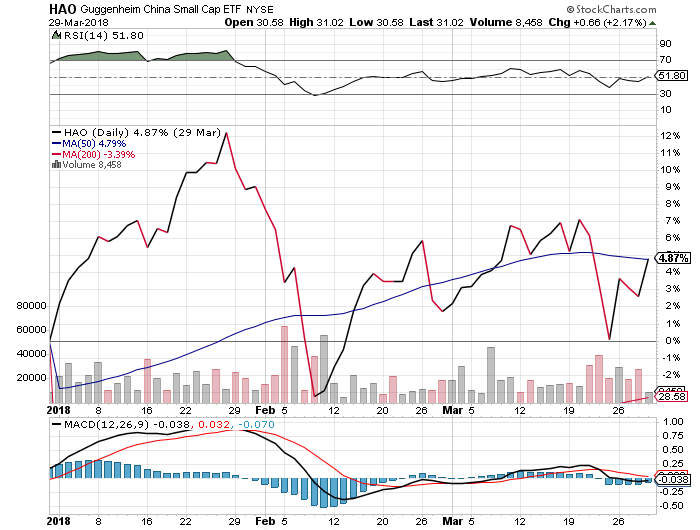

Asia

China Large Caps (FXI)

China Small Caps (HAO)

India (PIN)

Emerging Markets

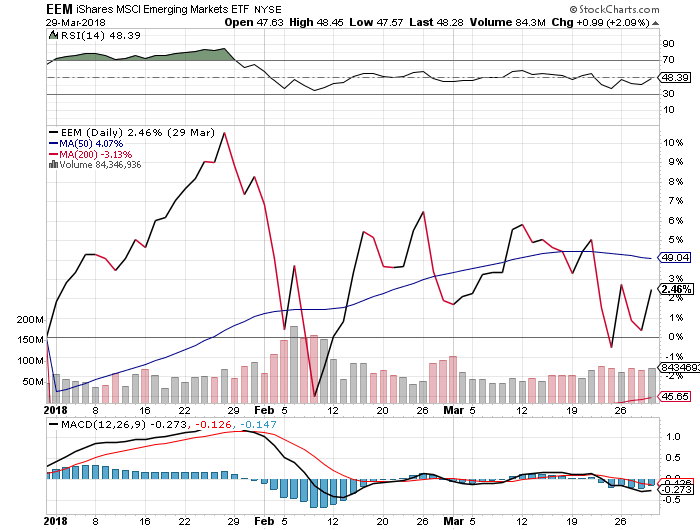

Emerging Markets (EEM)

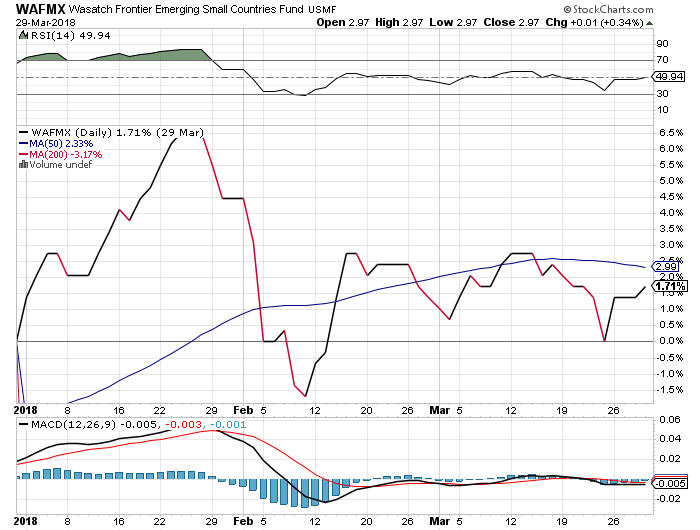

Frontier Markets (WAFMX)

Be the first to comment